Incentives

Local Incentives

To attract new businesses to locate in Indian River County, and encourage existing businesses to expand locally, the Board of County Commissioners established the Local Jobs Grant program. The program is performance-based, offering financial incentives to eligible "targeted" firms that create new full-time higher-wage jobs within the County and maintaining those jobs over multiple years. Those targeted industries are included in the county’s Comprehensive Plan and listed on the Targeted Industries page of this website. They include: manufacturing, warehouse/distribution, and corporate headquarters.

Targeted businesses that create five or more new full-time jobs paying at least 75% of the county's average annual wage are eligible to apply. The county's average annual wage used for incentive calculations is $53,863 (excluding benefits) or $25.90 per hour.

Qualifying businesses will be paid per job as outlined in the table below. An additional 10% bonus is available for a business that locates within the area formerly designated as the Indian River County/City of Vero Beach Enterprise Zone, which includes the Vero Beach Regional Airport and adjacent Gifford community just north of the airport.

|

Percent of Average Wage of New Qualified Jobs |

Grant Amount per New Job Created |

|---|---|

|

75% to 99.99% of county average annual wage |

$3,000 per job |

|

100% to 149.99% of county average annual wage |

$5,000 per job |

|

150% or more of county average annual wage |

$7,000 per job |

The Local Jobs Grant program is performance-based, meaning that, once approved by the Board of County Commissioners, the dollars awarded are encumbered, then paid to the company after the jobs are in place, usually over a 3-4 year period.

Indian River County also offers a Property Tax Abatement to eligible businesses that construct a new facility or make major renovations to an existing structure. Depending on the type of industry, the number of new jobs and the capital investment made, the increased property and tangible taxes from the improvements that are made are phased in (or "abated") for up to ten years. Please call 772-567-3491 for more information.

State Incentives

The Chamber's Economic Development Office works closely with SelectFlorida (formerly Enterprise Florida), our statewide economic development organization, to coordinate state programs to encourage new or expanding businesses to locate in, and bring new jobs to, Indian River County.

Florida's stable and highly favorable tax climate provides advantages that make a Florida location profitable for every type of business. Progressive legislation also ensures that Florida remains a worldwide hub for new and expanding businesses. And, Florida residents pay no personal state income tax. Click here to learn more about the benefits of establishing your business in Florida!

PLUS, manufacturers in Florida have even greater benefits, such as Sales Tax Exemptions on: the purchase of machinery and equipment; labor, parts and material used to repair equipment; electricity used in the manufacturing process; R&D equipment; along with several more exemptions!

CareerSource Research Coast, which serves as our regional workforce development office, offers a variety of training programs for new and expanding businesses, along with Training Grants for new or incumbent workers.

Federal Incentives

Foreign Trade Zone

Effective March, 2022, Indian River County is now a part of the St. Lucie County Foreign Trade Zone (FTZ) #218. Companies that import raw materials used in the assembly or manufacture of a finished product, and ship those products out of the U.S. can greatly benefit from this program. FTZs offer:

- Relief from inverted tariffs charged to component items or raw materials for your finished product.

- Duty exemption on re-exports - If the imported merchandise is part of a finished product that is exported back out of the country, no Customs duty is ever due.

- Duty elimination on waste, scrap, yield loss, or damages – much less paperwork involved, as no duty reimbursement needs to be requested when damaged goods are imported into the Foreign Trade Zone.

- Weekly Entry Savings - the zone user files only one Customs Entry per week, rather than filing one Customs Entry per shipment.

- Duty Deferral - duty is deferred until imported merchandise is shipped out of the designated Foreign Trade Zone into the U.S. market.

The expanded FTZ will be “site specific”, meaning a business can designate an area within their facility as an FTZ. The Chamber's Economic Development Office is working closely with staff in St. Lucie County and the Vero Beach Regional Airport to help local businesses with the application process.

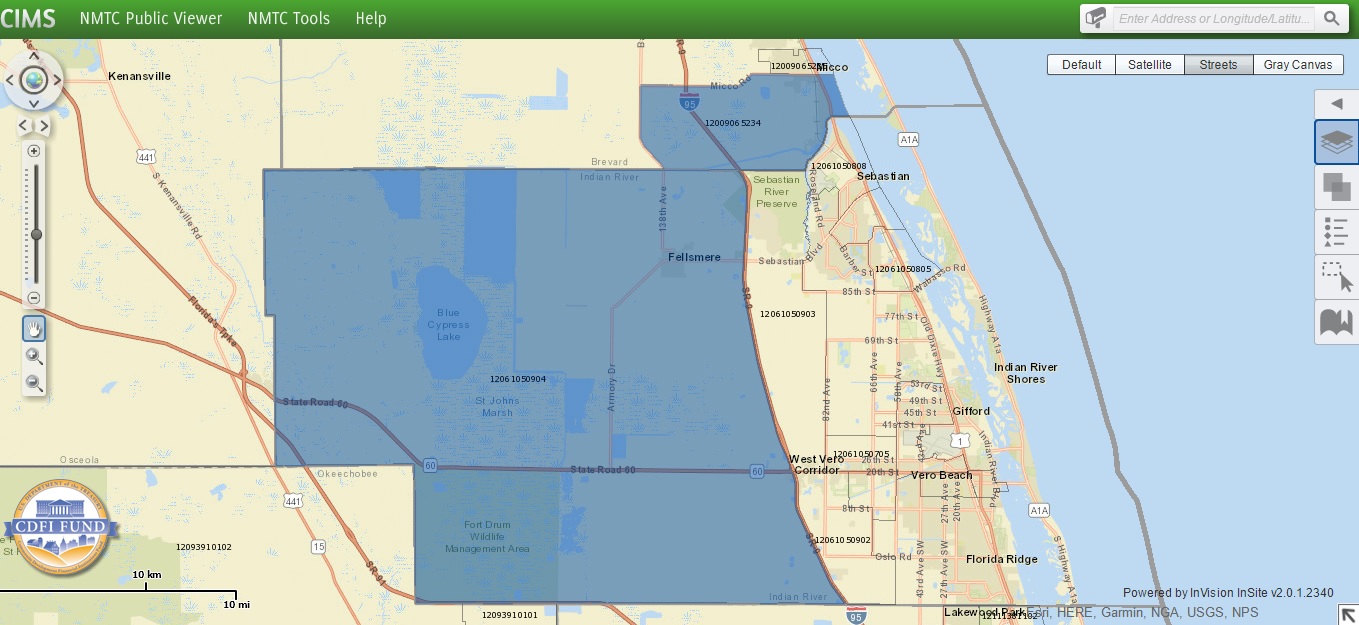

Opportunity Zones

Opportunity Zones are economically-distressed communities, certified by the U.S. Treasury Department, in which certain types of investments may be eligible for preferential tax treatment. The tax incentive is designed to spur economic development and job creation in distressed communities by providing tax benefits to investors. It allows investors to defer, or exclude, capital gains taxes through investments in federally established Opportunity Funds.

In Indian River County, all parcels west of I-95 are designated as Opportunity Zone properties, including land within the City of Fellsmere, the Vero Beach Industrial Park, and the Indian River Industrial Park - home of the CVS Distribution Center. To view a map of our Opportunity Zone, please click here.

In Indian River County, all parcels west of I-95 are designated as Opportunity Zone properties, including land within the City of Fellsmere, the Vero Beach Industrial Park, and the Indian River Industrial Park - home of the CVS Distribution Center. To view a map of our Opportunity Zone, please click here.

The full list of Florida Opportunity Zones, by census tract, can be found here. Click here for a list of FAQs regarding Opportunity Zones and Opportunity Funds.